Understanding the Sales Tax Rate in Ashtabula County, Ohio, is more than knowing a number it’s about learning how it impacts what you buy, how businesses operate, and why staying updated matters. In 2025, every consumer and business owner in Ashtabula County must follow a specific

Sales Tax Rate that combines both state and local taxes.

Whether you are a local shopper, an online seller, or someone starting a business in Ohio, understanding how sales tax works helps you plan better and stay compliant. From knowing the correct percentage and what products are exempt, to learning how to collect and pay it properly,

this guide breaks down everything you need to know about the Sales Tax Rate in Ashtabula County. By the end

, you’ll have a clear view of how it’s calculated, who must pay, and how it compares to other counties in Ohio making taxes simple and manageable.

What Is the Current Sales Tax Rate in Ashtabula County (2025)?

The current Sales Tax Rate in Ashtabula County, Ohio, for 2025 is 6.75%. This total is made up of the state tax rate of 5.75% and the county’s local portion of 1.00%. The combined figure applies to most retail sales, services, and taxable goods purchased within the county.

This Sales Tax Rate ensures both the state and local governments receive their share of revenue for public services, infrastructure, and community programs. When you purchase an item worth $100 in Ashtabula County, the sales tax you’ll pay is $6.75, bringing the total to $106.75

This rate represents a moderate level compared to other Ohio regions and is consistent across most areas in the county, making it easier for businesses and consumers to manage their tax responsibilities.

How the Ashtabula Sales Tax Rate Is Calculated

The Sales Tax Rate in Ashtabula County is calculated by combining the state portion and local portion of the tax. The state of Ohio charges a 5.75% base tax, while Ashtabula County adds 1.00% to support county-level services such as roads, schools, and law enforcement. Together, these form the total Sales Tax Rate of 6.75%. For instance, if a retailer sells an item worth $250, the total tax collected would be $16.87 ($250 × 6.75%). Businesses in Ashtabula must charge this percentage on taxable sales and remit it to the state. This straightforward system ensures uniformity across most cities in the county, minimizing confusion. The calculation process helps both consumers and businesses accurately plan for the total cost of purchases or pricing of goods and services.

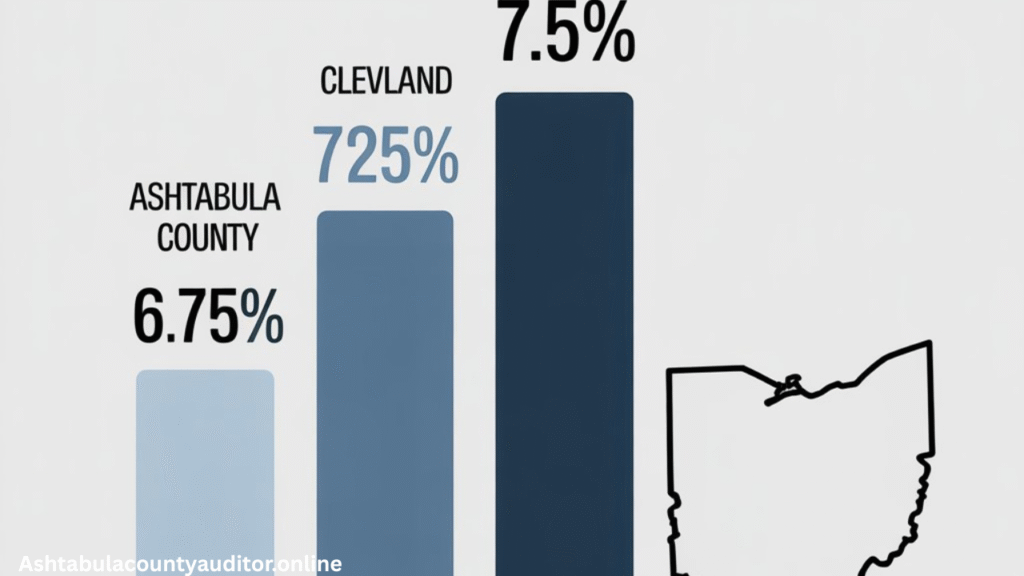

How Ashtabula’s Sales Tax Rate Compares to Other Ohio Counties

When comparing the Sales Tax Rate of Ashtabula County with other counties in Ohio, it becomes clear that Ashtabula sits on the lower-to-middle side of the scale. Larger counties like Cuyahoga (Cleveland) and Franklin (Columbus) often reach rates close to 7.25% or higher due to additional city or transit taxes. Meanwhile, rural or less densely populated areas like Ashtabula maintain a 6.75% rate, making it slightly more affordable for residents and businesses. For a shopper, this difference may seem small, but it adds up on large purchases. For businesses, a slightly lower Sales Tax Rate can make a county more appealing for operations, especially when calculating product pricing or competing with neighboring regions. The comparison highlights Ashtabula’s balance between maintaining public funding and keeping consumer costs fair.

What Items Are Tax-Exempt in Ashtabula County?

Not all goods and services are subject to the Sales Tax Rate in Ashtabula County. Ohio law provides exemptions for specific categories of items, helping reduce the financial burden on essential needs. Common tax-exempt items include:

- Most groceries for home consumption

- Prescription and some over-the-counter medications

- Certain medical equipment and supplies

- Sales made to nonprofit organizations or government entities

- Some manufacturing and agricultural products

These exemptions help protect basic living costs and encourage economic growth in key industries. Retailers must understand which items qualify so they don’t overcharge customers or underreport tax collections. For consumers, recognizing exempt products ensures accurate payments at checkout. Overall, these exemptions balance fairness in the Sales Tax Rate system while supporting both households and local businesses.

Who Needs to Collect Sales Tax in Ashtabula County?

Businesses or individuals making taxable sales within Ashtabula County are responsible for collecting the Sales Tax Rate on each qualifying transaction. This includes both physical stores and online sellers that meet Ohio’s “economic nexus” requirements typically based on annual sales volume or number of transactions within the state. Having nexus means your business has enough of a presence in Ohio to be legally required to collect and remit sales tax. Even remote sellers must comply if they exceed certain thresholds. This ensures fairness among local and online businesses. Whether you run a clothing shop in downtown Ashtabula or an e-commerce store shipping within the county, it’s your responsibility to apply the correct sales tax on every taxable sale and submit it on time. Staying compliant avoids penalties and builds credibility with customers.

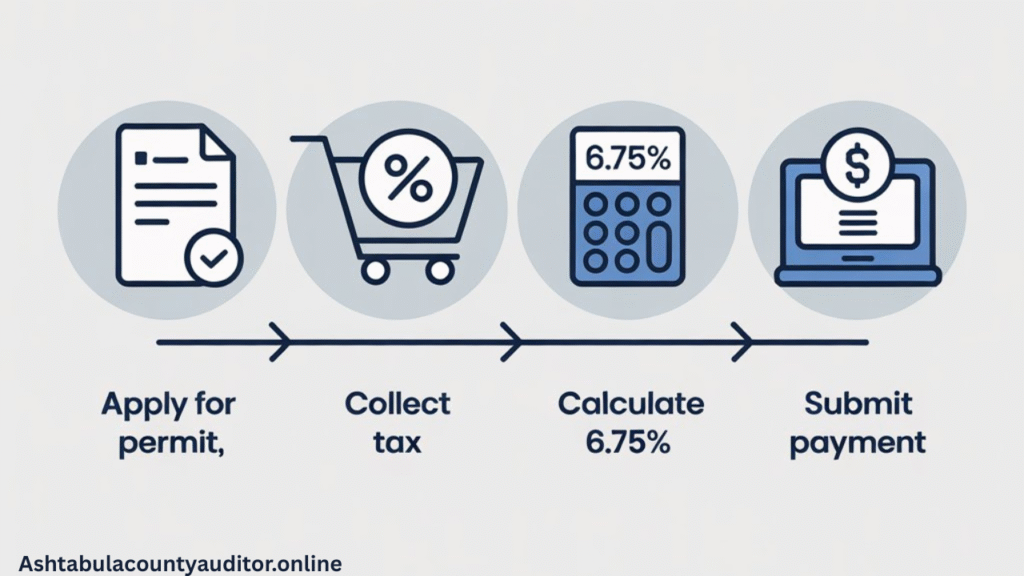

How to Register for a Sales Tax Permit in Ashtabula

Before a business can collect the Sales Tax Rate, it must first register for a sales tax permit or vendor’s license. The registration process in Ohio is simple and essential for operating legally. Business owners provide basic details such as company name, address, federal ID, business structure, and estimated sales. Once approved, the vendor’s license authorizes the business to charge and collect the 6.75% Sales Tax Rate on applicable sales. Without a permit, collecting tax is prohibited and may lead to fines or loss of business privileges. Registering early ensures you are fully compliant from day one. This step also provides a record for reporting and remitting collected taxes accurately to the Ohio Department of Taxation. In short, every business operating in Ashtabula County must obtain a valid permit before applying sales tax to customer transactions.

How to File and Pay Sales Tax in Ashtabula County (Step-by-Step)

Filing and paying sales tax in Ashtabula County is a routine responsibility for registered vendors. Once a business collects sales tax from customers, it must file returns periodically monthly, quarterly, or annually depending on total sales volume. The filing process involves reporting total taxable sales, applying the Sales Tax Rate, and calculating the total tax owed. Payment is then submitted to the state. Businesses should always double-check entries for accuracy, ensuring exempt sales are separated correctly. Late filings or incorrect payments can result in penalties or interest. Keeping organized sales records makes reporting easier. Most businesses use online portals to submit their returns, simplifying the process. Understanding how to file and pay the Sales Tax Rate in Ashtabula County ensures your business remains compliant and avoids unnecessary issues.

Common Mistakes to Avoid When Handling Sales Tax

Managing sales tax may seem straightforward, but even small errors can create big problems. One of the most common mistakes is failing to apply the correct Sales Tax Rate to every transaction. Some businesses use outdated rates or forget that local additions apply. Others fail to separate taxable and exempt sales, leading to overpayment or underpayment. Another frequent issue is missing filing deadlines or misplacing documentation needed for audits. To avoid these problems, keep current records, verify rates annually, and use a reliable sales tax calculator to confirm totals. Regularly reviewing your filing schedule and consulting tax professionals can save time and money. Remember, accuracy in applying and reporting your Sales Tax Rate is not just about compliance it reflects professionalism and trustworthiness in your business practices.

Useful Tools – Sales Tax Calculator for Ashtabula County

A sales tax calculator is an essential tool for anyone dealing with Ashtabula County’s Sales Tax Rate. Whether you’re a customer checking total costs or a business verifying tax collection, calculators simplify the process. To use one, simply enter the item’s price and the Sales Tax Rate of 6.75%. The calculator instantly provides the total amount of tax due and the final purchase price. For example, on a $500 purchase, the sales tax is $33.75, bringing the total to $533.75. These calculators are helpful for budgeting, invoicing, or confirming that the right amount is charged at checkout. Businesses can also integrate built-in tax calculators into their POS systems for greater accuracy. Using such tools eliminates manual errors and ensures the Sales Tax Rate is applied correctly on every transaction.

About the Author

This informational guide on the Sales Tax Rate in Ashtabula County, Ohio, was created to help residents, shoppers, and business owners understand how local taxation works in 2025. With years of experience researching tax regulations, the author aims to simplify complex financial topics into clear, practical insights. The information shared here supports accuracy, compliance, and awareness, making tax management easier for everyone involved. Always review the latest updates from official sources to stay current with sales tax changes.

Related Guides

- Sales Tax in San Diego City, California in 2025

- Sales Tax in Fresno City, California in 2025

- Sales Tax in Anaheim City, California in 2025

These related guides highlight how Sales Tax Rates differ across states and counties, offering helpful comparisons for readers who conduct business or shopping in multiple areas. Each location follows its own structure, but the principles of calculation, collection, and compliance remain consistent nationwide.

Conclusion

Understanding the Sales Tax Rate in Ashtabula County, Ohio, empowers you to make informed financial decisions and maintain compliance with state laws. In 2025, the 6.75% rate reflects a balanced approach between supporting public services and keeping costs reasonable for consumers. Whether you’re managing a local business, making retail purchases, or operating an online store, applying the correct Sales Tax Rate is essential. From exemptions and registration to filing and payment, every step contributes to a transparent and fair system. Staying informed, using reliable tools, and reviewing updates annually ensure that you handle sales tax confidently and correctly. When you understand how your Sales Tax Rate works, you build stronger business practices and contribute positively to your local community’s economic health.

FAQs.

What is the current Sales Tax Rate in Ashtabula County for 2025?

The total Sales Tax Rate in Ashtabula County, Ohio for 2025 is 6.75%, including 5.75% state tax and 1% county tax.

2. How does Ashtabula County’s Sales Tax compare to other counties in Ohio?

Ashtabula’s Sales Tax Rate is slightly lower than urban areas like Cleveland and Columbus, offering moderate rates for both residents and businesses.

3. Do online sellers need to collect Ashtabula County Sales Tax?

Yes. If your business has a sales tax nexus in Ohio, such as physical presence or exceeding the sales threshold, you must collect the Sales Tax Rate on online sales.

4. Which products are exempt from Ashtabula County Sales Tax?

Most groceries, prescription medicines, and some clothing items are exempt from the Sales Tax Rate in Ashtabula County, following Ohio’s tax laws.

5. How can I apply for a sales tax permit in Ashtabula County?

You can register for an Ohio Vendor’s License online via the Ohio Business Gateway to legally collect the Sales Tax Rate in Ashtabula.

6. How do I file and pay my Ashtabula County Sales Tax?

Businesses can file and pay through the Ohio Business Gateway by reporting total taxable sales, applying the 6.75% Sales Tax Rate, and submitting payments electronically.

7. What happens if I fail to pay the Ashtabula Sales Tax on time?

Late payments can result in penalties, interest, and possible audits from the Ohio Department of Taxation. It’s important to file on time each quarter.

8. Does the Sales Tax Rate in Ashtabula apply to services?

Some services are taxable depending on the type, but many professional or labor services remain exempt under Ohio tax law.

9. Will the Sales Tax Rate change in Ashtabula County in 2026?

Tax rates can change annually due to local or state legislation. Stay updated with the Ohio Department of Taxation for the latest figures.

10. How can businesses make Sales Tax collection easier?

Using automated accounting tools or POS systems helps apply the correct Sales Tax Rate, track taxable sales, and simplify filing for Ashtabula County businesses.